A Perspective on the New Mortgage Process

Impact of New Mortgage Process

The new mortgage process and title company requirements were implemented on October 3, 2015. It has been about 9 months since the Consumer Financial Protection Bureau (CFPB) started this.

The goal of the CFPB is to protect the consumer from being treated unfairly when it comes to anything related to financing. This can include car loans, student loans, credit cards, or mortgage loans for example.

CFPB changed the mortgage process and title process to be more transparent to consumers and easier to understand.

This is a review from a Buyers Agent Perspective…

Loan Estimate

Buyers are required to get their Loan Estimate (LE) within 3 business days of their loan application. This LE is the lenders commitment to a buyer about the fees and terms of the loan. There are stipulations to this forms so that lenders do not add last minute fees right before closing.

The mortgage broker is required to have certain fees very accurate, or what they call zero tolerance. Those charges are lender fees and transfer taxes. Regarding any other fees, the mortgage broker is required to make good faith effort to find out and verify accuracy of all the other fees, but many mortgage brokers do not bother.

A good mortgage broker will contact the title company to get accurate fees. I find most mortgage brokers are not taking that extra step. Instead they are estimating title fees and hope it will not exceed the 10% inaccuracy threshold. Most title companies can provide this information quickly, it really does not make sense that a mortgage broker cannot pick up the phone in order to provide the buyer accurate fees. Especially when the mortgage process guidelines require them to do so.

There will be fees that no one can verify until the end of the transaction such as HOA fees. Should the final zero tolerance fees be inaccurate or other fees are more than 10% off from the actual, the mortgage broker is required to pay the buyer the difference.

It pays to select a good mortgage broker that is experienced and goes the extra mile for buyers.

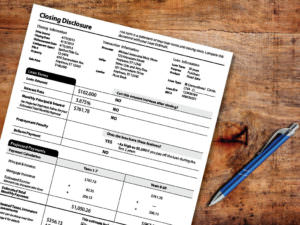

Closing Disclosure

The intent of the Closing Disclosure (CD) was to provide the buyers with their final fees 3 business days before closing, so buyers would have a chance to review ahead of closing. While this process has benefits, they are suppose to be accurate, but most Closing Disclosures are not accurate.

Closing Disclosures are not allowed to be provided to the buyers agent, only the final Closing Statement. I routinely ask the buyers for their copy, so I can catch mistakes ahead of closing. Recently, my buyer received the (CD) and buyers were already told by their lender to wire $XXX,XXX. I told him to send it to me for review, because many times they are not accurate. After receiving this buyers CD, I could see right away, there were missing perorations and large fees added that were a sellers cost. As a result, I saved the buyer $4,000.

Related: Will a mortgage modification work for you?

Do not rely on the CD to be the final figure you bring to closing. Ask us.

The Closing Statement is the final figures that buyer should bring to closing, but lenders no longer review these statements. What I find is, if there are mistakes on the Closing Disclosure, they get carried over to the Closing Statement. Closing Statements sometimes are finished on the day of closing.

Keep your buyers agent involved in the mortgage process so that mistakes can be caught. Home buyers should do not pay any more than needed.

Buyers Broker of Florida is a buyers agency in Central Florida that works ONLY for the best interests of the home buyer. You owe it to yourself to consult with their office when buying a home. 407-539-1053. You will be glad you did.

Back Home

Back Home

Leave a Reply